Life insurance can be a wise and prudent way to mitigate risk and it can be a terrible investment vehicle. Don’t get left with too little coverage or the wrong kind with this easy guide. Continue reading

insurance

All of the media attention goes to female birth control because the Biblical stance on ladies is solid, but what about male erectile dysfunction (ED) medication like Cialis and Viagra? What are the Biblical implications of allowing those pills to be covered on company provided insurance or for Christian doctors who want to prescribe ED treatment in good faith?

This guide will help companies and doctors of good morals uphold Christian values. Continue reading

I woke up at my friend’s house in the middle of a serious snowstorm. I roused my other buddy from the couch and told him, “We passed out. We gotta get out of here.”

“What time is it?” he asked.

I glanced at the digital clock across the room and vaguely made out some numbers. “Threes and fours, man – we gotta go.” Continue reading

In Massachusetts, home of RomneyCare, legislators are taking a new look at health care costs and are proposing new ways to bring those costs down.

Since instituting the universal, individual mandate healthcare coverage the Commonwealth has been forced to address the question of skyrocketing healthcare costs. More people on insurance and more government funded health plans has brought the inequities of commercial insurance payouts to light. Continue reading

Ever heard of FEMA? I’m sure in this post-Katrina age we live in that you have. The Federal Emergency Management Agency steps in to provide assistance when a disaster strikes somewhere in the US. But that’s not all. FEMA also offers the National Flood Insurance Program to provide coverage for people living in areas that are considered to be in a hazard zone for flooding. Participation in the flood insurance program is deemed mandatory when your property is in a Special Flood Hazard Area. With a standard annual premium of $1800 or more, even ‘if the creek don’t rise’ the cost of your insurance could surely drown you. Continue reading

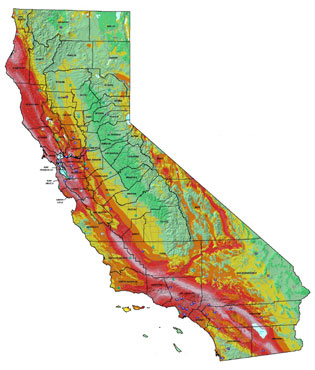

The recent tragedy in Japan has many people in earthquake prone areas of the US wondering if they should purchase earthquake insurance. Let’s look at the likelihoods, costs and benefits. We’ll look at California because data is readily available and Cthulhu’s wrath has been predicted to be focused on the San Francisco Bay Area.

How Likely Is an Earthquake?

“Probabilistic seismic hazard maps… are typically expressed in terms of probability of exceeding a certain ground motion. For example, the 10% probability of exceedance in 50 years maps depict an annual probability of 1 in 475 of being exceeded each year. The maps for 10% probability of exceedance in 50 years show ground motions that we do not think will be exceeded in the next 50 years. In fact, there is a 90% chance that these ground motions will NOT be exceeded.”

But, a smaller amount of ground movement is more likely and is almost certain to happen at some point in the next 30 years.

The red ares of this map are the highest level of ground movement and line up with large population areas. The conclusion is that shaking will occur, we don’t know when and we don’t know how bad it will be.

That gives rise to the need to mitigate the risk of property loss when an earthquake does happen. But what exactly does earthquake insurance cover and how much does it cost? Those factors are driven by coverage levels, structure replacement value and location.

What Does Earthquake Insurance Cover?

- Repair, or in the event of a total loss, replacement cost, of an insured home when damage exceeds the policy’s deductible, up to the policy limit.

- If you cannot live in your home after an earthquake, you may be eligible for additional living expenses up to your policy limit.

After the deductible has been met by covered damage to your home, the policy will replace personal property such as furniture and household items, up to your policy limit. - Your policy will pay up to $10,000 (as part of the dwelling limit of insurance), including engineering costs, to replace, stabilize or restore the land that supports your home.

What Does Earthquake Insurance Not Cover?

- Detached garages and most other structures that are not part of the dwelling itself

- Land damage, other than $10,000 in coverage for land stabilization

- Swimming pools and spas

- Awnings and patio coverings

- Fences

- Certain decorative or artistic items such as mirrors, chandeliers, stained glass, or mosaics

- Landscaping and irrigation systems

- Antennas and satellite dishes

- Patios, decks, walkways, and driveways not needed for pedestrian or disabled access to your home

- Plaster, to the extent that the repair cost exceeds the value of drywall

- Exterior masonry veneer (with the exception of stucco, which is covered)

- Damage caused in whole or in part by causes other than earthquakes, such as fire during or following an earthquake (in most cases, fire damage is covered by your homeowners insurance policy); water damage resulting from floods or surface water; power failures; explosions; or non-seismic land sliding

- Certain categories of personal property, including glassware, crystal, porcelain, artwork, motor vehicles, boats, and trailers

How Much Does Earthquake Insurance Cost?

The cost depends on many factors but a rough estimate is that it is going to be in the same annual premium range as the existing homeowner’s policy.

For example, using nice round numbers, if a home is completely destroyed and costs $200,000 to replace the structure then the out of pocket expenses would be $30,000 plus the cost of all the items that the earthquake insurance does not cover.

If an earthquake strikes 10 years from now and a homeowner pays $1,500 per year then they’ve put in $15,000 in premiums, $30,000 in deductibles and several thousand more for uncovered items. The 10 year cost is close to $50,000 in this scenario with total property destruction. If your property damage is less than $30,000 then the policy pays nothing.

All of this does not apply if your home is destroyed by a tsunami resulting from and earthquake. For that you’re going to need flood insurance, but that’s a different article.

What If You Don’t Have Coverage?

Then you’re out of luck. You now own a pile of rubble with a mortgage. In some cases the government will provided federal disaster grants but those are usually less than $15,000. At this point you should just turn the useless keys over to the mortgage holder and rent an apartment.

Obviously if you’re lucky enough not to own a home then you can ignore this whole thing and just get renter’s insurance which is far less expensive.

Important Note: Crasstalk is not an insurance professional and should not be used as a replacement for one.

Coverage information source: CEA.